Token Tokenomics

The Token Tokenomics page provides comprehensive information about a token's economic structure, including unlock schedules, token distribution, and vesting details. This powerful tool helps you understand the token supply dynamics and potential market impact of upcoming unlocks.

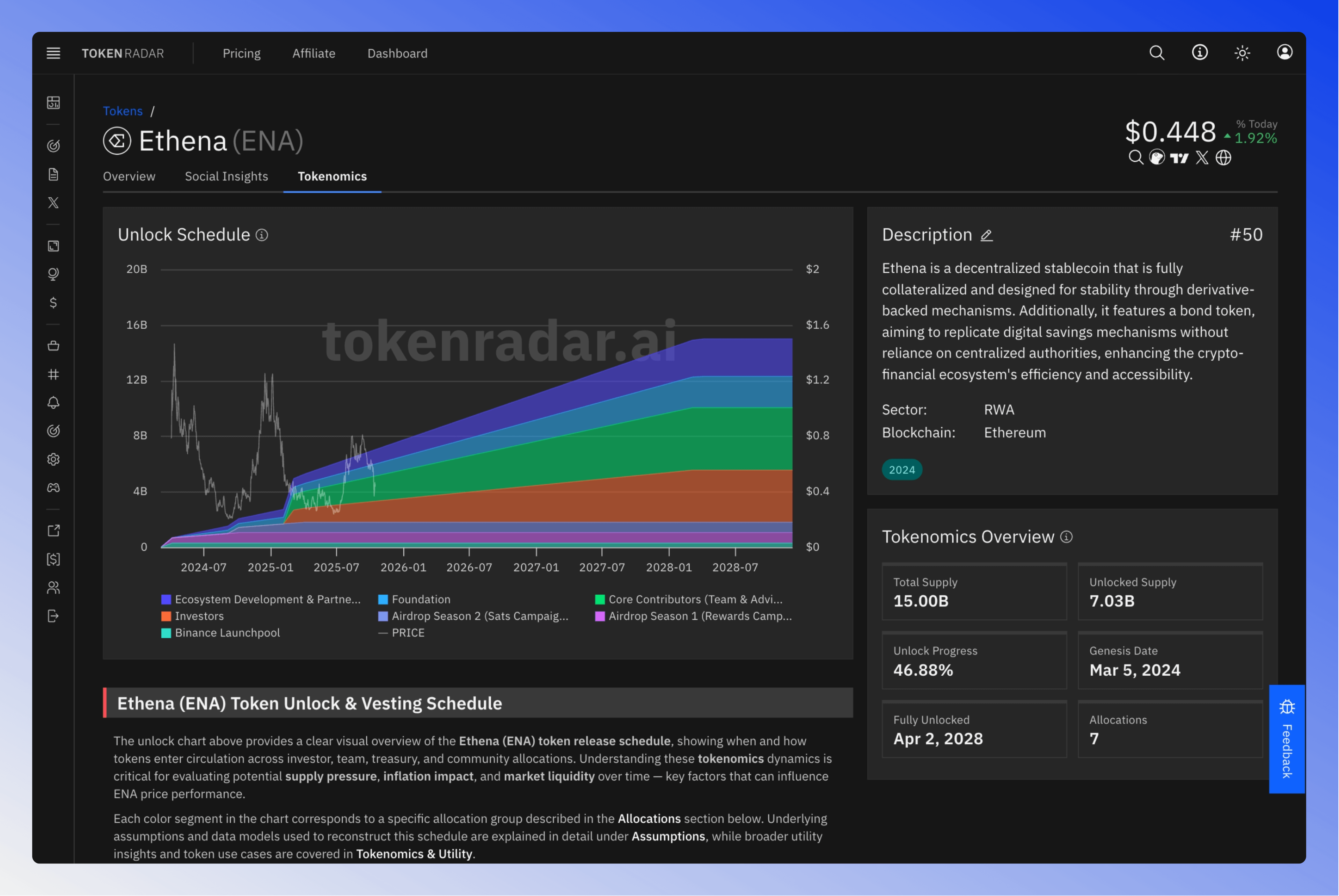

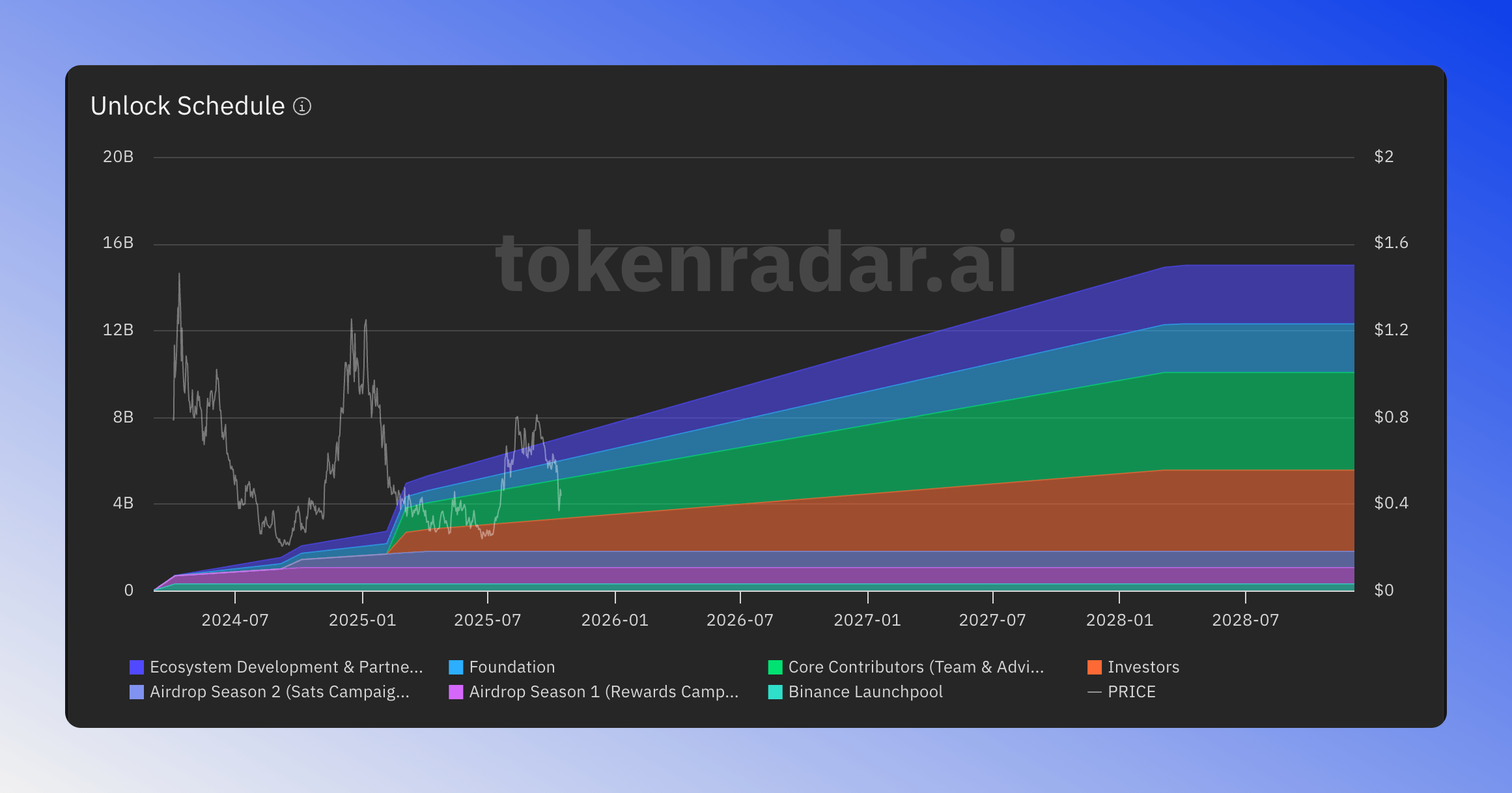

Unlock Schedule

The unlock schedule chart displays a visual representation of token unlocks over time:

- Stacked areas show different allocation categories (e.g., Community Treasury, Team & Advisors, Investors)

- Color-coded sections make it easy to identify which allocations are unlocking at any given time

- The chart is overlaid with the token's price movement, allowing you to correlate unlock events with price action

- Hover over the chart to see detailed information about unlocks at specific dates

Tokenomics & Utility

This section provides essential information about the token's purpose and economic model:

- Token description: Overview of the token's role in the ecosystem

- Utility: How the token is used within the platform or protocol

- Supply information: Total supply, circulating supply, and maximum supply

Assumptions

The assumptions section outlines key scenarios and projections for token unlocks:

- Scenario descriptions: Different unlock events with dates and percentages

- Vesting schedules: Detailed breakdown of when tokens become liquid

- Each assumption includes relevant dates and token amounts to help you plan accordingly

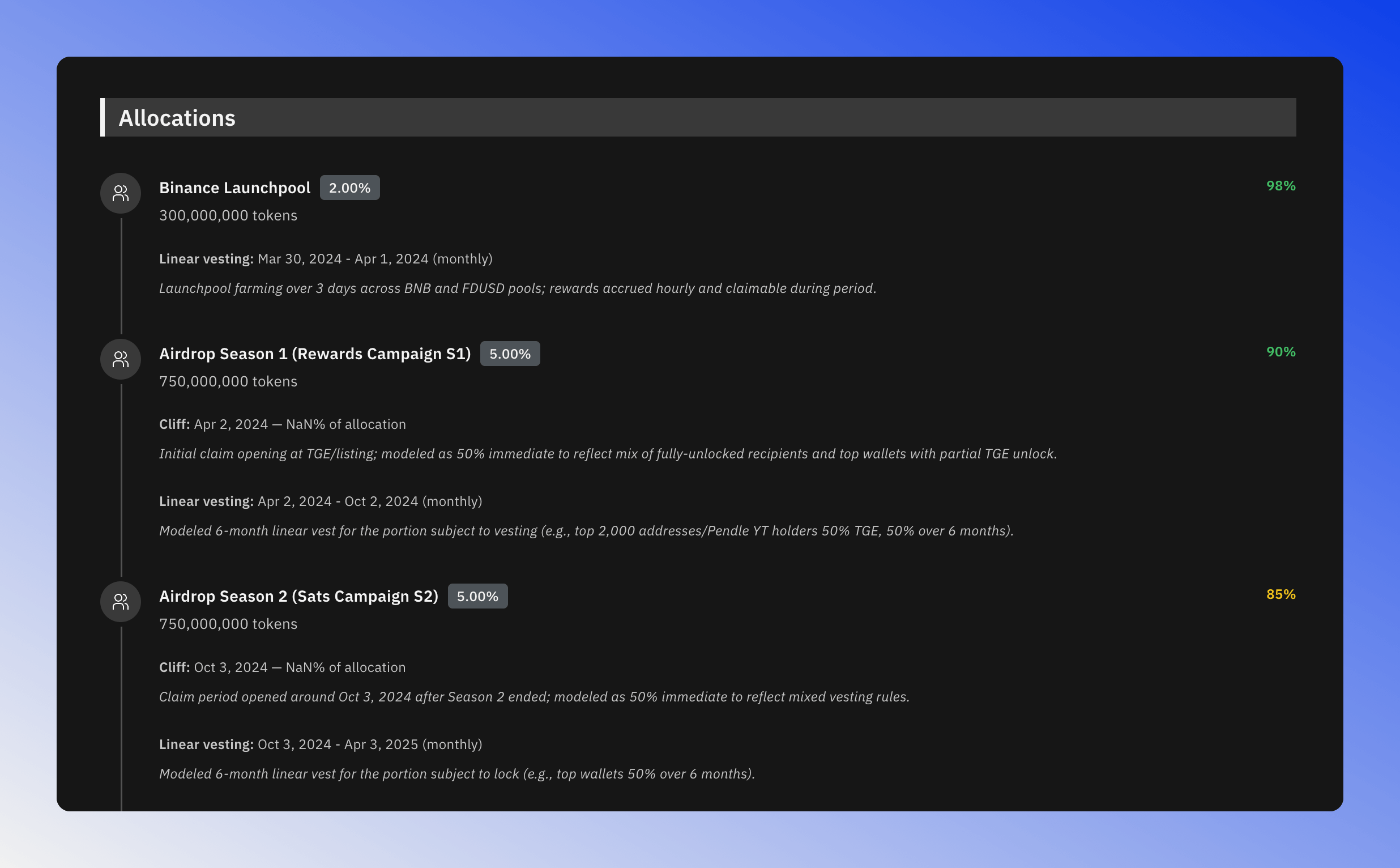

Allocations

The allocations section provides detailed information about how tokens were distributed:

Each allocation entry includes:

- Allocation name: The category or funding round (e.g., Binance LaunchPad, Seed Round)

- Percentage: Share of total token supply

- Token amount: Number of tokens allocated

- Vesting details:

- Linear vesting schedules with start and end dates

- Cliff periods before vesting begins

- Monthly unlock amounts

- Additional notes: Special conditions or important details about the allocation

This comprehensive view helps you understand the token's distribution and anticipate potential selling pressure from upcoming unlocks.